Get in touch

555-555-5555

mymail@mailservice.com

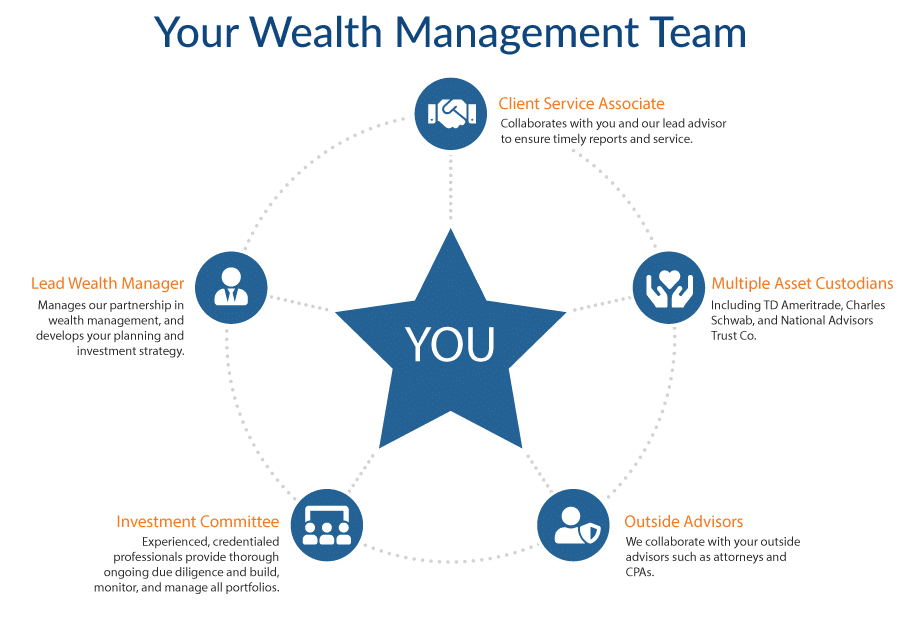

Partners In Managing Your Wealth

Alpha Fiduciary partners with you to ensure our wealth solutions reflect the dynamics of your whole life.

We’ll remain available to you so that you’ll never be left in the dark when it comes to your wealth.

We believe in offering dynamic wealth management services, we make ourselves available to collaborate with any outside advisors to address tax issues, estate planning, legal matters, major purchases, insurance, etc.

Our Wealth Management Process:

Meeting 1:

Discovering your needs

- Determine what is important to you, your goals and your fears

- Discuss your investment goals and expectations

- Define your personal and financial goals

Meeting 2:

Defining your wealth plan

- Set the framework for our professional relationship

- Establish responsibilities and expectations

- Determine your wealth planning team, including outside advisors

Meeting 3:

Building your plan

- Discuss investment recommendations based on our prior meetings

- Discover ways to optimize both asset allocation and asset location

- Design your risk-conscious, tax-efficient portfolio to meet your specific needs

- Review the investment plan

- Determine the course of action

Meeting 4:

Reviewing your wealth plan

- Review client-advisor responsibilities

- Determine which steps still need to be completed

- Track goal progress

- Reevaluate and adjust the wealth plan if necessary

- Amend any timelines or expectations as needed

Keep Your Wealth Plan On Track